Municipal Assessment

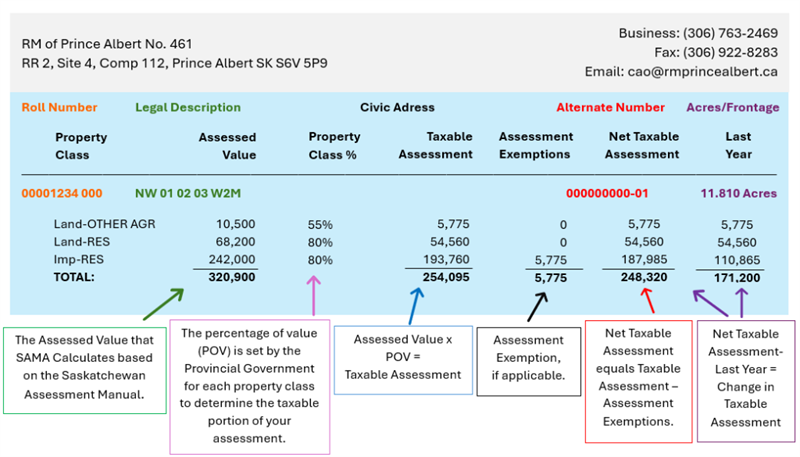

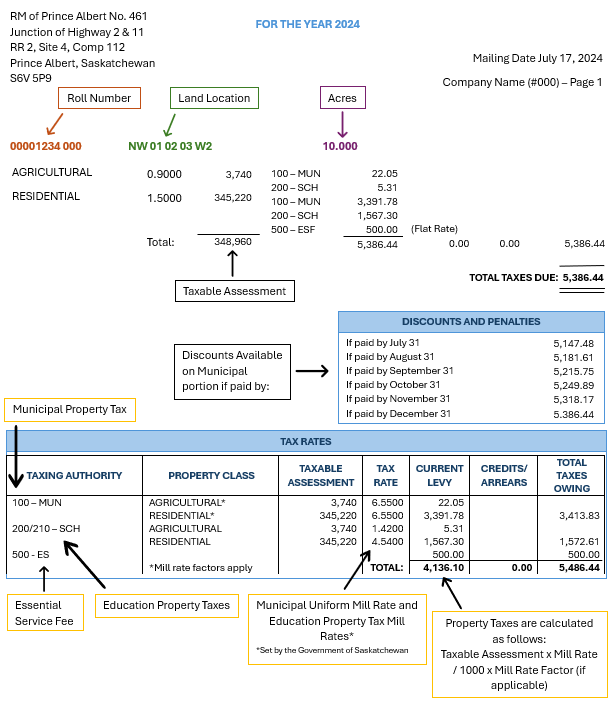

The RM of Prince Albert uses the Saskatchewan Assessment Management Agency (SAMA) to calculate and update all assessments within the municipality. SAMA performs annual maintenance updates to properties showing an increase or decrease in assessment.

The provincial government mandates SAMA to conduct periodic revaluations of all Saskatchewan properties every four years to coincide with the change to a new base date. A full revaluation of all properties was completed province wide in 2021 using a 2015 base date. Provincial legislation requires municipalities to use these values when determining tax amounts for a property.

2025 will be the next revaluation assessment year.

The SAMA website is a useful resource that provides information on property assessment in Saskatchewan.

For further information regarding Property Assessment and Taxation can be found on the Government of Saskatchewan website.